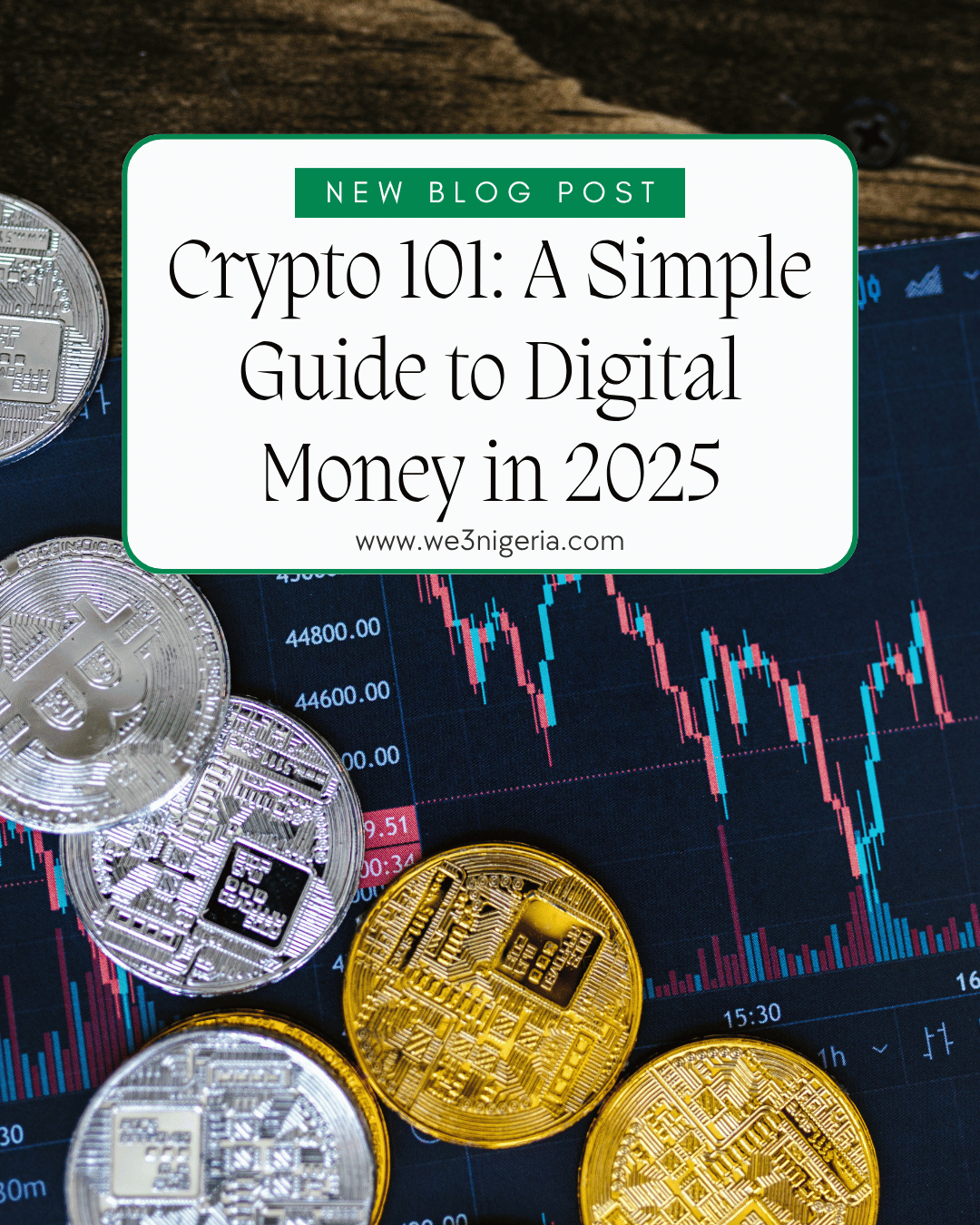

The way we use money has changed forever. While the first cryptocurrency, Bitcoin, was created to enable secure, non-cash transfers, its role has exploded far beyond a simple payment method. Today, digital assets power everything from buying goods and collecting funds for ambitious projects to serving as a massive global investment tool.

In 2025, cryptocurrency isn’t just a niche product; it’s an accepted part of the modern financial system. Major companies like Microsoft, Steam, and Starbucks have integrated it, and governments worldwide are grappling with how to regulate it.

This guide answers the most important questions: What is crypto, how does it work, and why do we still need it?

What is Cryptocurrency? (The Basics)

A cryptocurrency is a digital currency secured by cryptography (advanced coding). These digital units have no physical form; they exist only in virtual space. Unlike the money in your bank account, which is controlled by a central bank (fiat currency), cryptocurrencies are decentralized.

The technology that makes this possible is called the Blockchain.

Bitcoin: The Origin Story

The term “cryptocurrency” entered common use after the launch of Bitcoin (BTC) in 2009 by an anonymous figure known as Satoshi Nakamoto. Its founding principles were:

- Decentralization: No single government or organization controls it.

- Security: Protected against fraud by cryptography.

- Transparency (of the network): All transactions are recorded on a public ledger.

Crucially, Bitcoin’s supply is strictly limited to 21 million coins. This scarcity makes it naturally resistant to the kind of inflation that occurs when governments print more traditional money.

How Does the Blockchain Work?

The blockchain is the foundational mechanism for almost all crypto. Think of it as a shared, digital ledger spread across thousands of computers globally.

- Blocks and Chains: Financial transactions are bundled together into a “block.” Once complete, this block is permanently linked to the previous block using a unique cryptographic code, creating a continuous “chain” of data.

- Immutability: Once a block is added, it cannot be changed or deleted. If someone tries to tamper with it, the chain breaks, and the entire network is notified immediately, guaranteeing the integrity of the data.

- Consensus: For any new transaction block to be added, most users on the network must verify and approve it. This decentralized approval process eliminates the need for a bank as a middleman.

In early crypto like Bitcoin, this consensus was achieved through Mining (known as Proof-of-Work), where people used massive computing power to solve complex mathematical problems to validate the blocks and earn new coins. Due to complexity and energy use, newer systems often use more efficient methods like Proof-of-Stake.

The Different Kinds of Crypto

While Bitcoin is the original, the market has expanded dramatically.

1. Bitcoin (BTC): Digital Gold

Bitcoin remains the most sought-after and expensive coin, primarily serving as a store of value (like digital gold) and a powerful investment tool.

2. Ethereum (ETH): The Smart Platform

Founded in 2015, Ethereum is more than just a currency; it’s a global platform for building new online services and applications. It introduced Smart Contracts—self-executing, automated agreements that automatically transfer assets when certain conditions are met, paving the way for decentralized finance (DeFi).

3. Altcoins

This term refers to any coin that isn’t Bitcoin. Altcoins (Alternative Coins) appeared to solve some of Bitcoin’s problems, such as slow transfers or limited application outside of currency. Projects like Solana and Binance Coin (BNB) now rank among the top 10, often emphasizing speed, lower costs, or unique platform utility.

4. Stablecoins

These are digital currencies whose value is linked (or pegged) to a tangible asset like the US dollar (e.g., Tether (USDT) or USDC). Their price remains stable, making them ideal for digitally transferring money with minimal risk and as a safe digital haven during market volatility.

5. NFTs (Non-Fungible Tokens)

An NFT is a unique, non-interchangeable digital asset used to prove ownership of real-world or digital items like art, music, or videos. Unlike Bitcoin, where one coin is identical to the next (fungible), each NFT token exists only in a single, unique copy. This feature is widely used for monetizing popularity and enabling digital collecting.

Why Crypto is Better Than Traditional Banking

Cryptocurrencies solve several fundamental issues inherent in the traditional banking system, which is why their mass adoption continues:

- Decentralization and Immutability: No single entity can freeze your account, censor a transaction, or manipulate the money supply. You are your own bank, and your records cannot be changed.

- Inflation Protection: With a known, limited supply, assets like Bitcoin protect capital from the devaluation that occurs when governments print excessive fiat currency.

- Accessibility: Crypto eliminates the need for banks. All you need is internet access and a crypto wallet to participate in the global financial system, allowing unbanked populations to engage in the digital economy.

- Efficiency and Cost: For cross-border transactions, crypto can offer low transaction costs and potentially higher transaction speeds compared to slow, fee-heavy international bank wire transfers.

- Privacy and Security: The blockchain’s cryptographic nature guarantees the security of your funds, while some cryptocurrencies offer anonymity for users who want to keep their financial transactions confidential.

Wallets: How You Hold Your Digital Assets

Unlike the money we are used to, cryptocurrencies are not stored in bank accounts. Instead, users rely on a crypto wallet to hold the private key—a unique cryptographic code—that grants access to their assets on the public blockchain.

- Hot Wallets: Connected to the internet (like accounts on centralized exchanges such as Coinbase). These are convenient for regular use but generally carry a slightly higher risk.

- Cold Wallets: Stored entirely offline (on specialized hardware devices or files). This provides the highest level of security against hacking, as the private key is never exposed to the network.

Conclusion: The Road Ahead

Cryptocurrencies are no longer a curiosity, but a thriving, global industry that has fundamentally challenged the traditional banking system. While the benefits of using cryptocurrencies are obvious, serious obstacles to mass adoption remain.

These challenges include a low level of public awareness, the lack of a unified global regulation for transactions, and the technical complexity of integrating blockchain solutions into business operations.

Despite these hurdles, the market is actively developing, with new platforms, opportunities, and increasing seriousness from countries trying to integrate these digital assets into their economies. It is only a matter of time before cryptocurrencies become a global standard.

Leave a Reply

View Comments