Nigeria has solidified its position as one of the world’s most vibrant crypto markets. Driven by a youthful, tech-savvy populace and urgent economic necessity—including rampant inflation and currency instability—millions have adopted digital assets like Bitcoin and stablecoins as essential financial tools. The nation consistently ranks in the global top 10 for adoption, recording over $59 billion in crypto transactions between July 2023 and June 2024.

Initially fueled by underground, peer-to-peer (P2P) trading to bypass regulatory hurdles, Nigeria’s crypto landscape has fundamentally shifted. Recent regulatory actions and major fintech advancements have transitioned the market from an informal P2P economy to a clearer, institutional-grade ecosystem.

2025: Regulatory Clarity & Institutional Adoption

The year 2025 was pivotal, marked by key milestones that cemented the role of blockchain in Nigeria’s mainstream finance:

1. Blockchain Modernizes Banking Infrastructure

In a landmark move, the Nigeria Inter-Bank Settlement System (NIBSS) partnered with Zone’s blockchain network. This integration modernized Nigeria’s core financial infrastructure, enabling faster, more transparent interbank settlements while drastically reducing fraud risks. Nigeria is now setting a global standard for how traditional finance can embrace decentralized technology.

2. Fintech Surges with Crypto at the Core

Nigeria’s fintech ecosystem celebrated a major win as digital payment platform Moniepoint achieved unicorn status (a $1 billion valuation), securing investments from giants like Google. This growth underscores Nigeria’s dominance in financial innovation, with blockchain and crypto solutions being central to its mission for financial inclusion.

3. CBN Lifts Crypto Banking Ban

Following the Central Bank of Nigeria’s (CBN) crucial decision in late 2023 to lift the ban on banks servicing crypto businesses, licensed exchanges can now operate freely. This pivotal shift has injected massive investor confidence and cleared the path for regulated market growth.

The New Rulebook: Nigeria’s ISA 2025

Nigeria took a decisive step toward regulatory certainty in 2025 by passing the Investments and Securities Act (ISA 2025). This law provides a clear framework for digital assets, placing them under the direct oversight of the Securities and Exchange Commission (SEC).

Key Aspects of the ISA 2025:

- Mandatory Licensing: All Virtual Asset Service Providers (VASPs) and crypto exchanges must now register with the SEC. Early approvals went to established platforms like Quidax and Busha.

- Expanded Oversight: The law now explicitly covers investment-focused NFTs and online forex trading platforms, ensuring assets marketed as financial products face regulatory scrutiny.

- Stronger Fraud Protection: ISA 2025 explicitly bans Ponzi schemes and empowers regulators with new tools, including access to telecom records for investigations, to aggressively combat fraud.

- Unified Oversight: The SEC, CBN, EFCC, and NFIU now coordinate, creating a more unified and effective system to balance innovation with consumer protection.

Catalysts for Sustainable Crypto Growth

Nigeria’s crypto economy is driven by unique local challenges, positioning digital assets as essential solutions rather than mere speculative investments:

1. The Remittance Lifeline

Cryptocurrencies are essential for remittances and cross-border payments. Digital assets offer a faster and cheaper alternative to traditional channels, circumventing the high fees and foreign exchange restrictions that plague the traditional banking system for the estimated $20 billion in annual remittances.

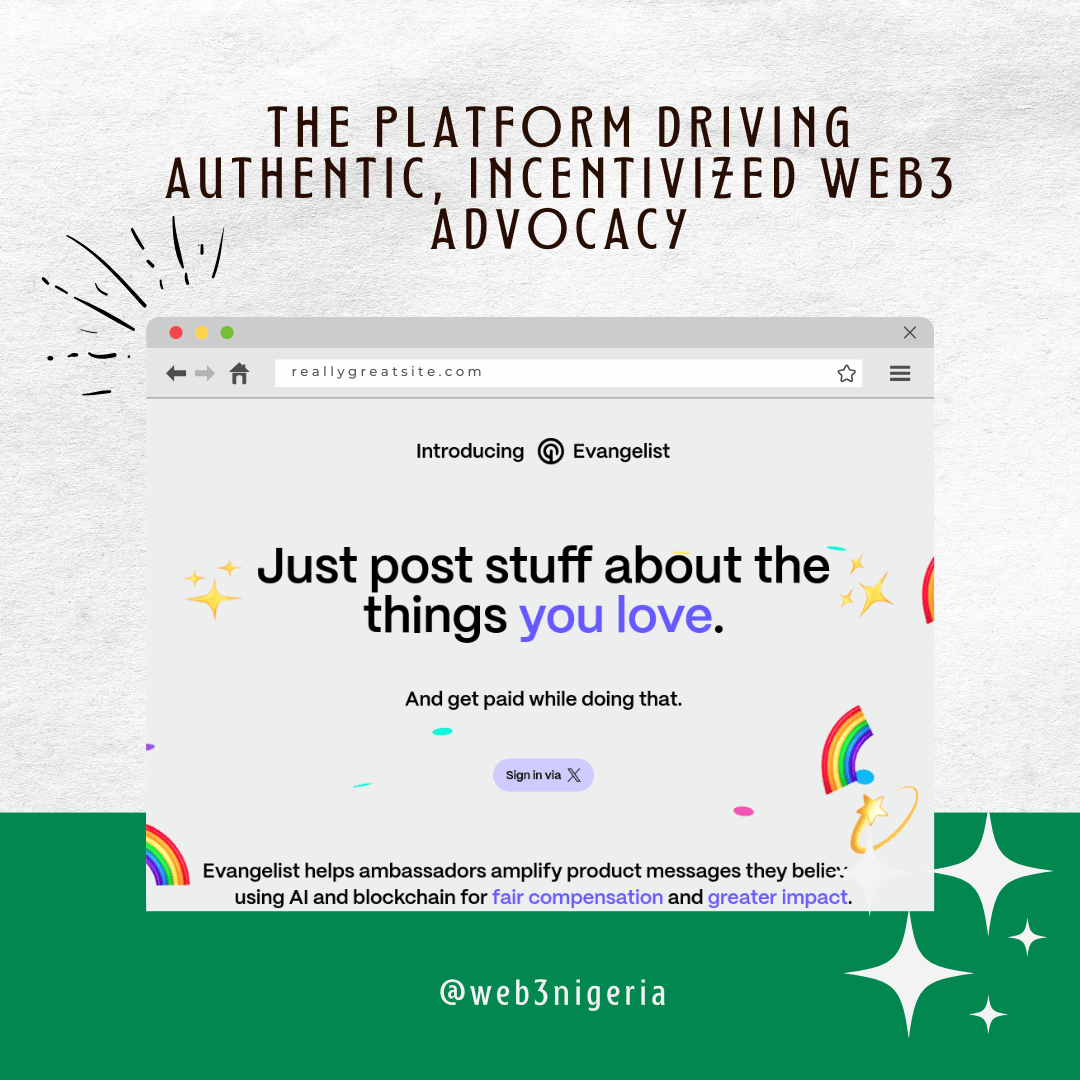

2. Homegrown Web3 Innovation

An emerging ecosystem of blockchain startups is building solutions tailored for the African market. Homegrown giants like the exchange Yellow Card and Web3 infrastructure ventures like Nestcoin are creating localized tools for decentralized finance and digital identity, directly addressing Nigeria’s high inflation and limited banking penetration.

3. Considering Bitcoin for National Reserves

In the most ambitious proposal yet, policymakers are exploring the potential of adding Bitcoin to Nigeria’s national reserves. This high-level discussion, though still controversial, signals crypto’s growing acceptance as a potential hedge against Naira volatility and an alternative store of value.

Nigeria’s journey is now firmly focused on building the foundations for long-term success. With regulatory clarity, a vibrant fintech sector, and core blockchain integration in banking, the country is poised to lead the global future of digital finance. Nigeria’s crypto economy is no longer just an alternative—it is the future.

Leave a Reply

View Comments